Silver plan for android app

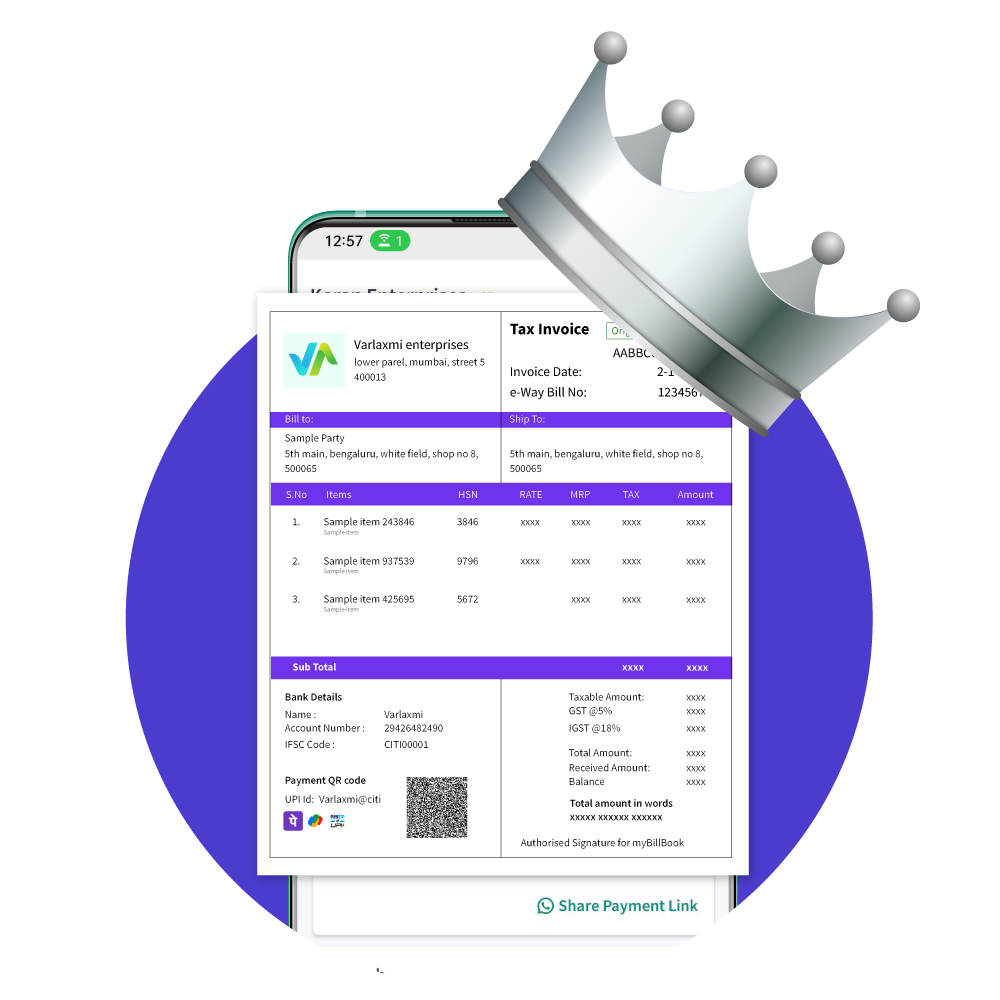

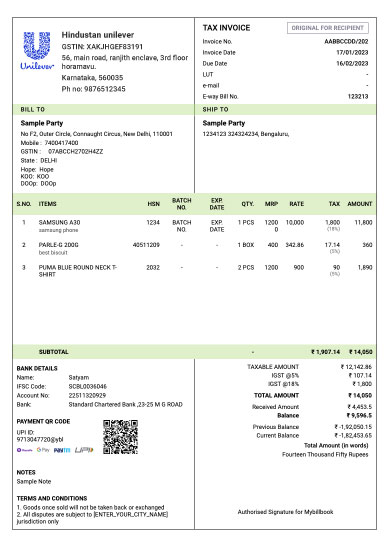

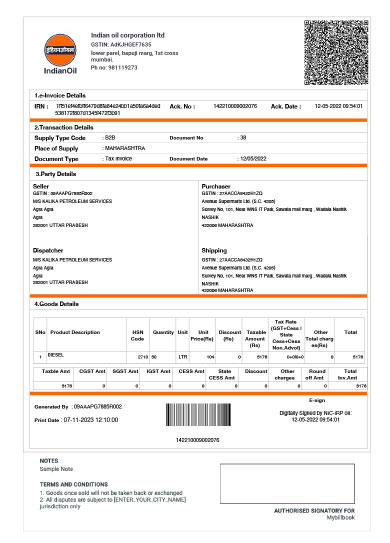

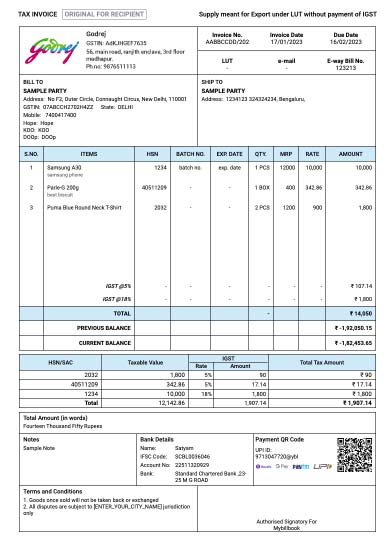

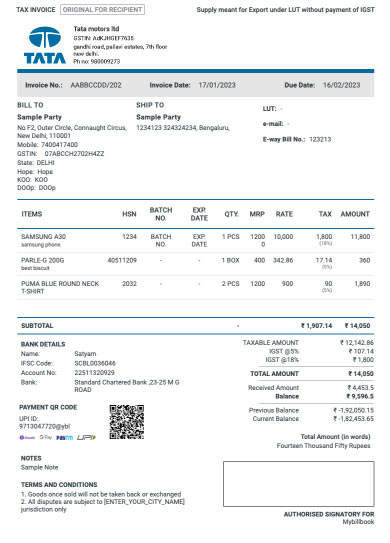

✅ Generate unlimited GST / non-GST Bills

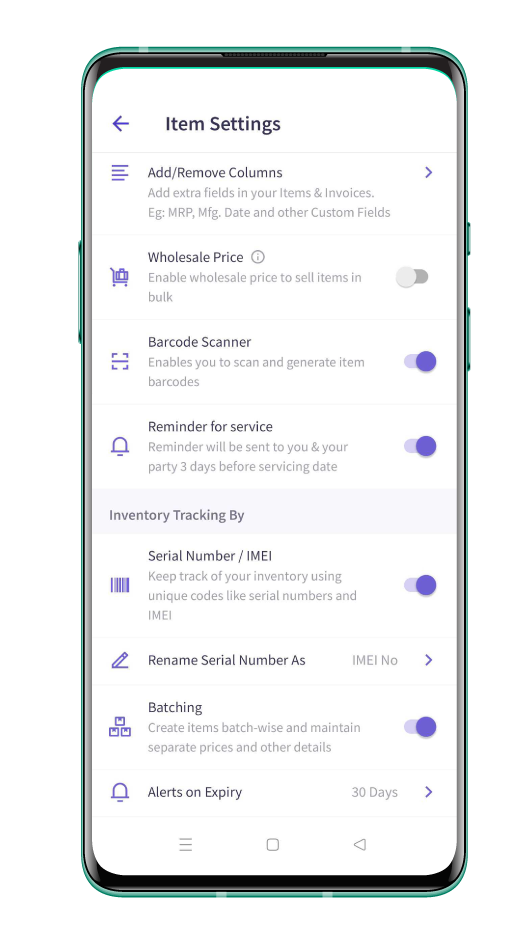

✅ 50+ invoice customisation settings

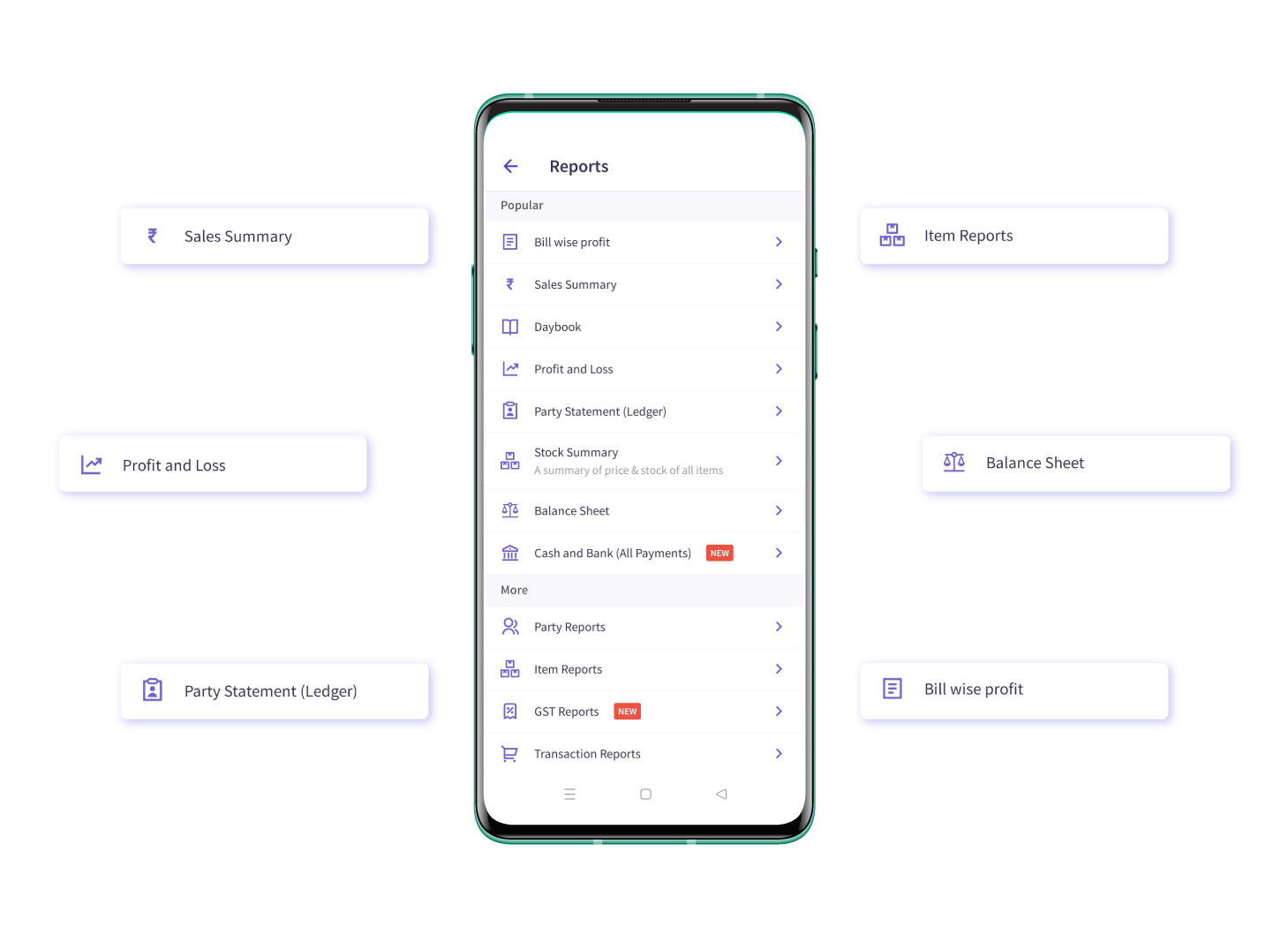

✅ Easy tax filing with GSTR-1 reports

🌟 Only ₹399/year

Ready to purchase?

Get up to 35% off on multi-year plans.

Talk to Sales