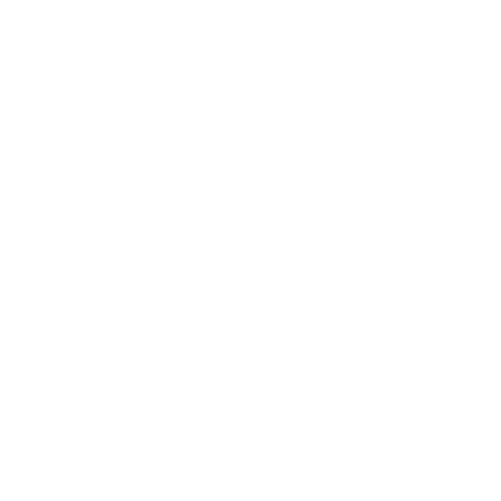

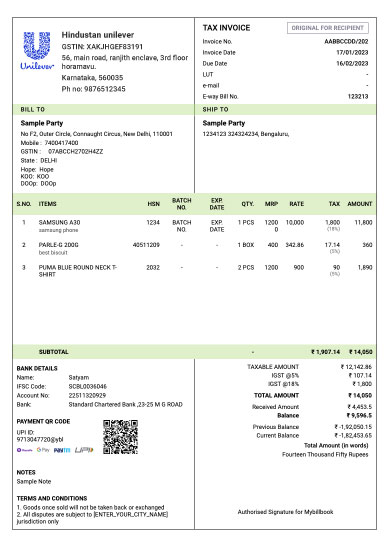

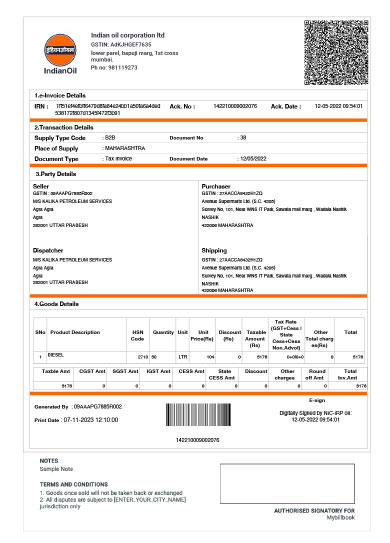

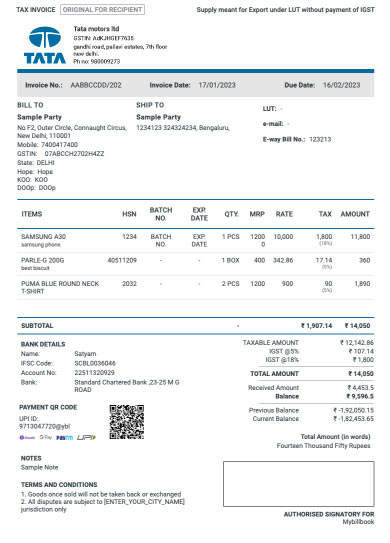

Simplify transporting goods with easy e-Way bill generation on myBillBook

Integrated with GST billing and e-Invoicing | 25+ smart error validations | Zero manual work

✔ Paid plans starting from ₹34/month

Ready to purchase?

Get up to 35% off on multi-year plans.

Talk to Sales