~5 lacs saving

from billing errors

Plans starting from ₹34/month

Trusted by more than 1 Crore+ businesses

from billing errors

in overdue payments

order processing

Select contact from your phone or create a new Customer or upload Customer list with details like GST, PAN, address etc

Create and add a new Item or upload Item list with details like sales price, discount, category etc

Print, download and share the invoices to your customers in PDF format over WhatsApp/SMS

Share error-free Bills quickly on Whatsapp, Email, SMS or Print

Send payment reminders (automatic or manual)

Track party-wise due payments with accurate reports

Add unique IMEI, Serial Numbers, Batch Numbers and Expiry Dates

Generate unique barcode or use Scanner Gun to add existing

Set stock limits to notify you when stock runs low

Add Godowns to specify stock location

Customise Invoices as required with additional columns

Use Advanced features to grow your business successfully

1.3L Total Reviews

1.3L Total Reviews

"Superb customer service. They are easily available on phone and Whatsapp."

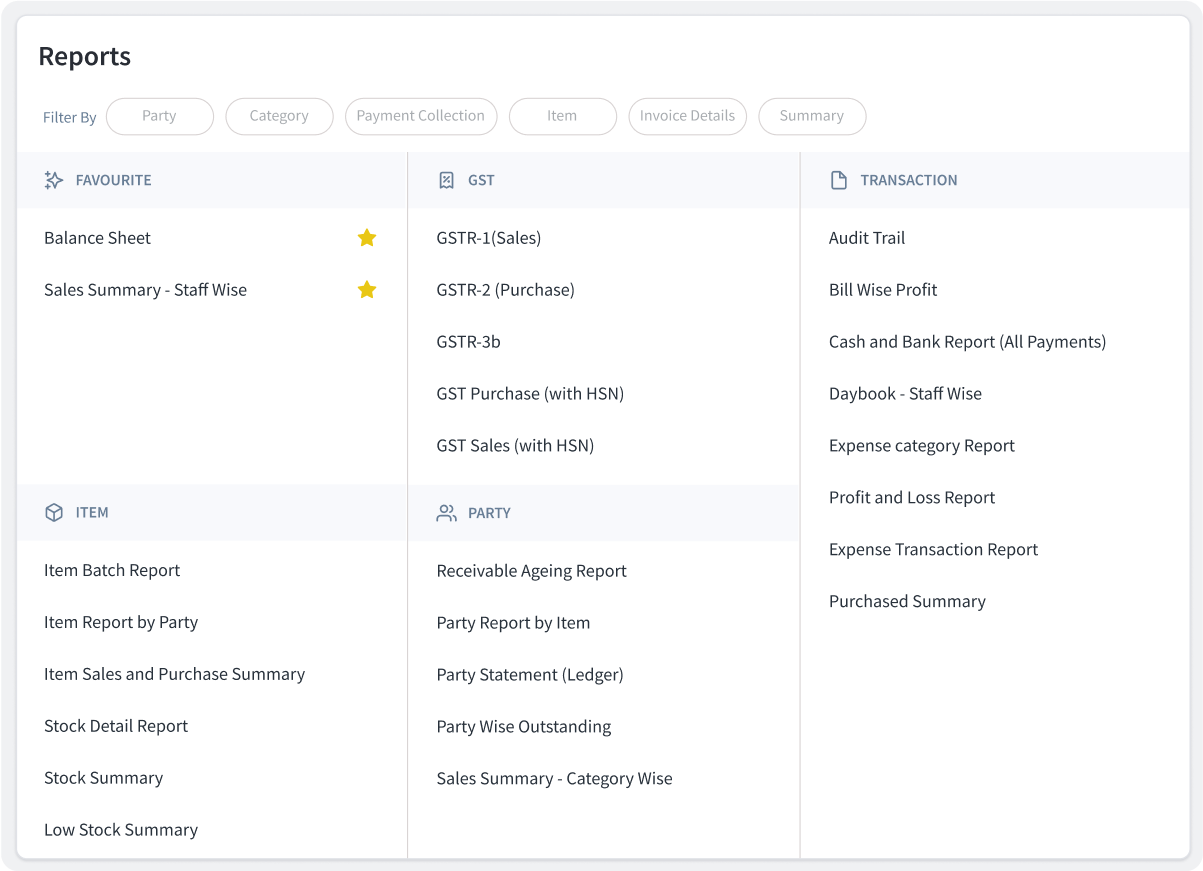

GST 1, 2 and 3b reports

Audit trail

Export JSON to import into GST portal

eWay Bills and B2B e-Invoices

Auto send monthly reports to CA

Powered by GST Suvidha Provider

myBillbook has helped us to quickly respond for price estimates and close new orders

RGP Stone Suppliers - Vijayawada

myBillbook has simplified our GST reconcillation. We are now getting full Input Tax Credit

SS Electrical Appliances - Noida

With myBillbook we have managed to increase festival sales by 35%

Mobile Shoppee - Bangalore

Add up to 1 business + 1 user

Add up to 1 business + 1 user Create unlimited invoices

Create unlimited invoices Inventory management

Inventory management App + Web support

App + Web support Priority customer support

Priority customer support GSTR reports in JSON format Popular

GSTR reports in JSON format Popular Add up to 2 business + 2 user

Add up to 2 business + 2 user 50 e-Way bills/year

50 e-Way bills/year Staff attendance + payroll

Staff attendance + payroll Godown management

Godown management Whatsapp and SMS marketing

Whatsapp and SMS marketing Custom invoice themes

Custom invoice themes Create your online store

Create your online store Generate and print barcode

Generate and print barcode POS billing on desktop app

POS billing on desktop app Unlimited e-Invoices & e-Way bills

Unlimited e-Invoices & e-Way bills