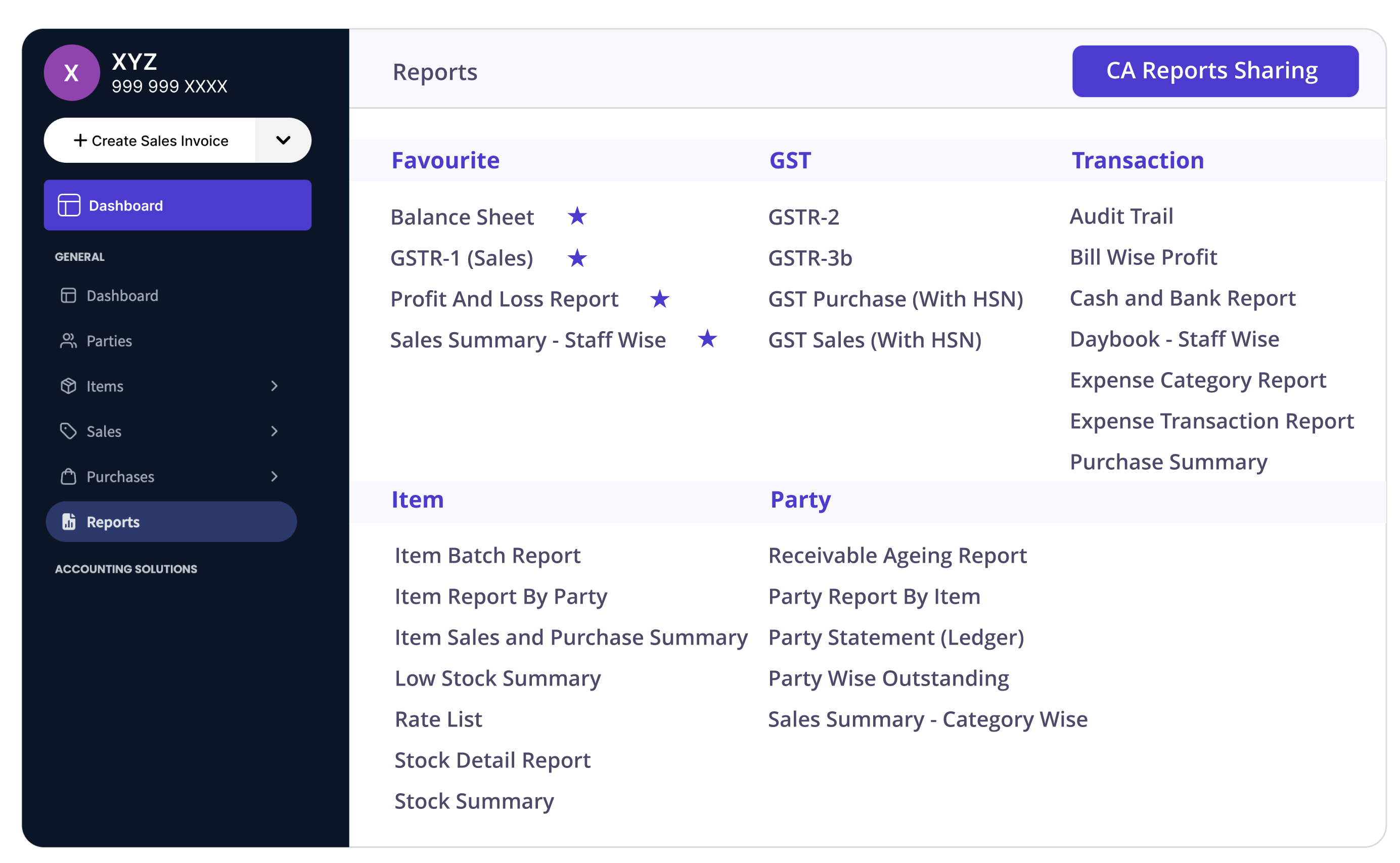

Best GST accounting software

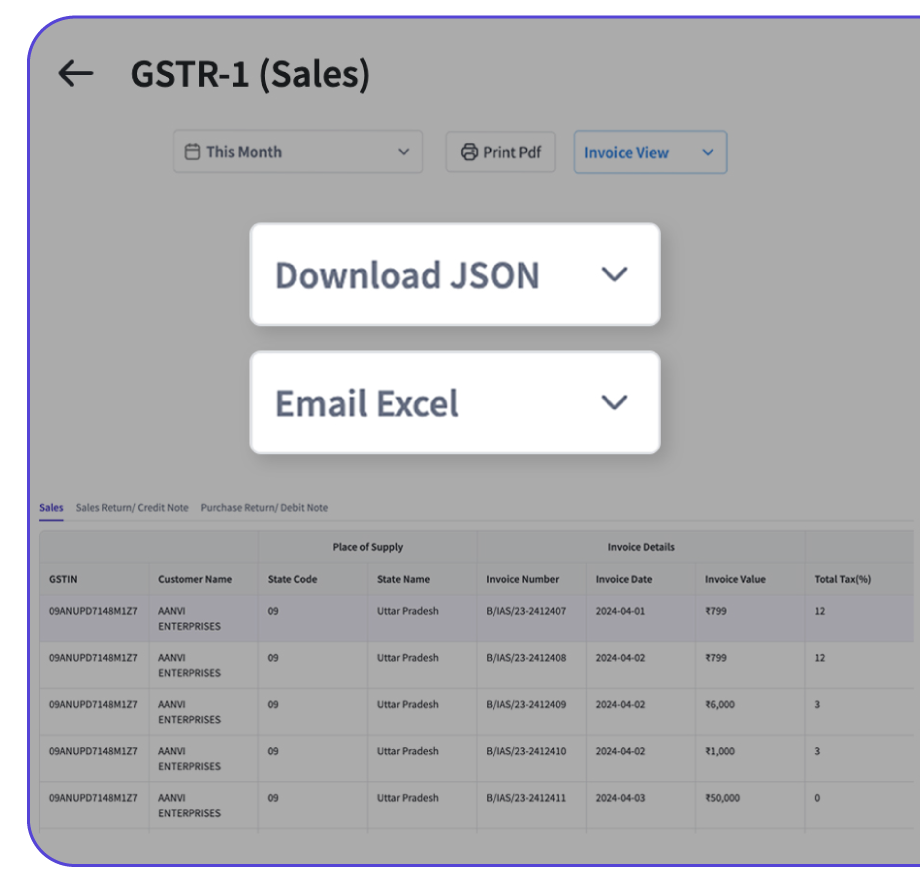

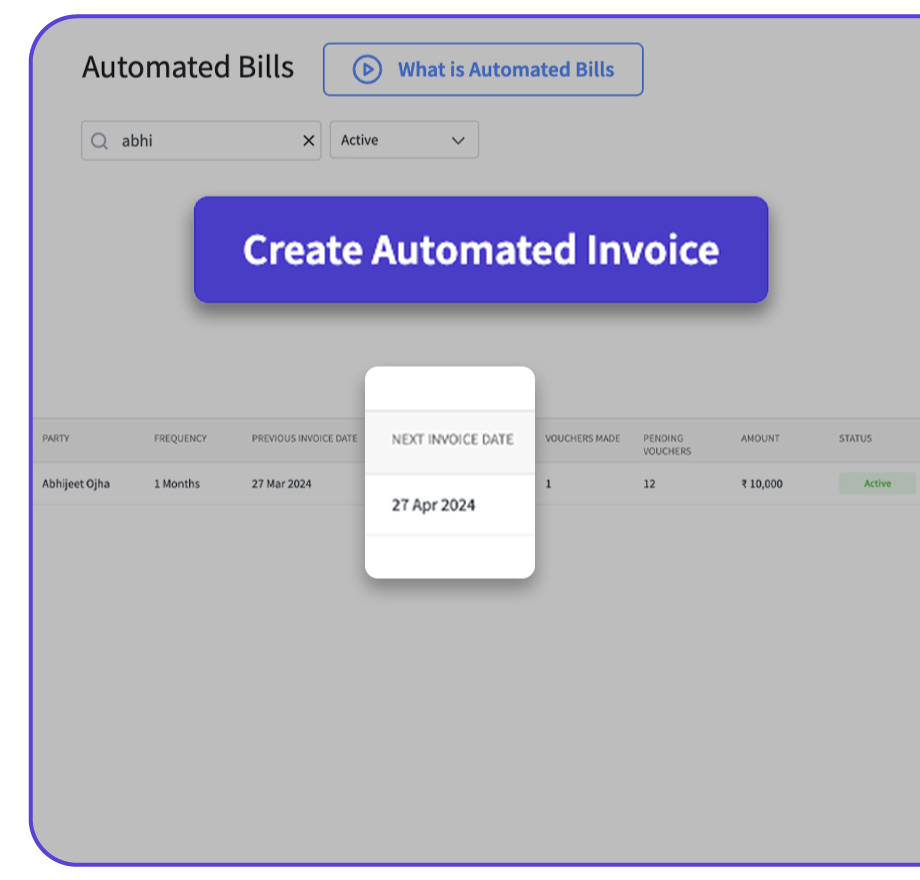

✅ File GST returns with ease

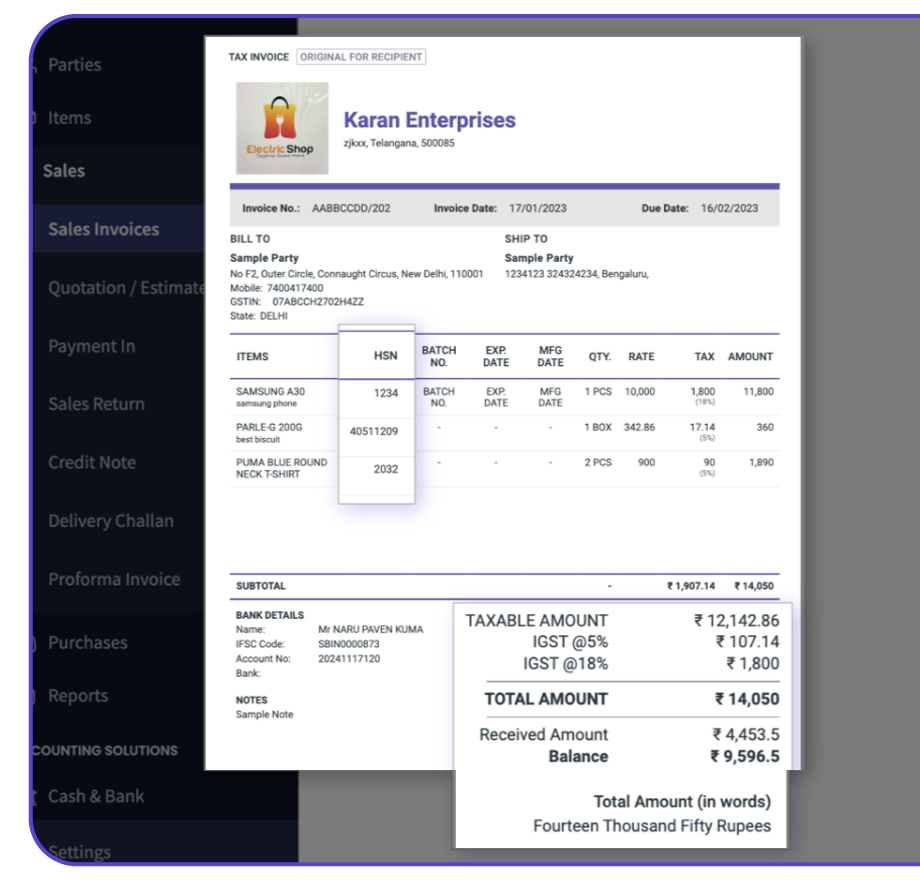

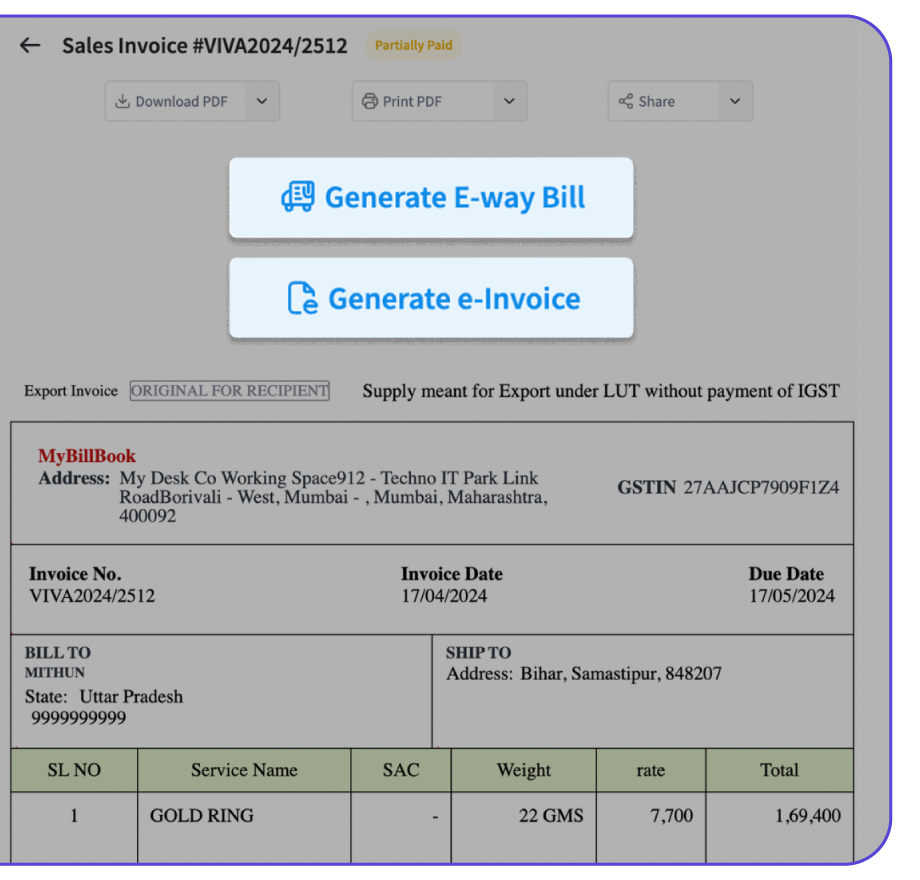

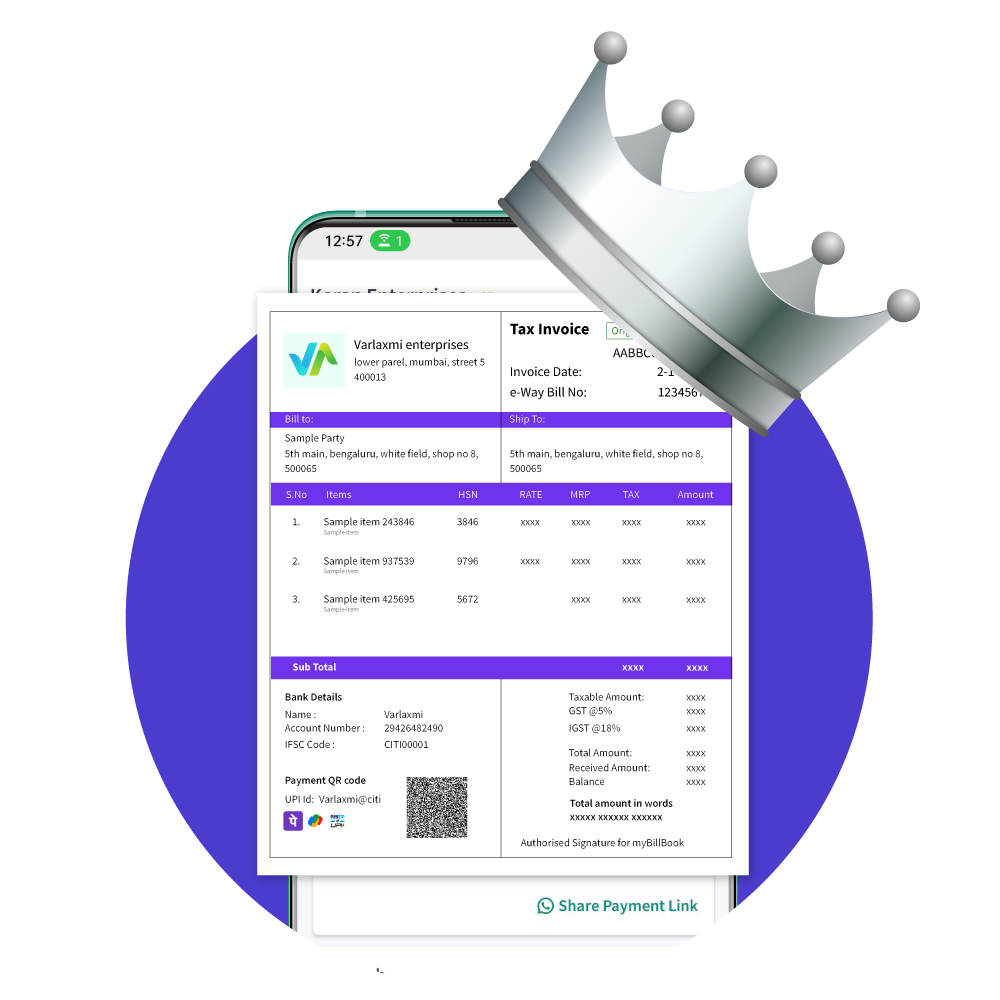

✅ Generate GST compliant invoices

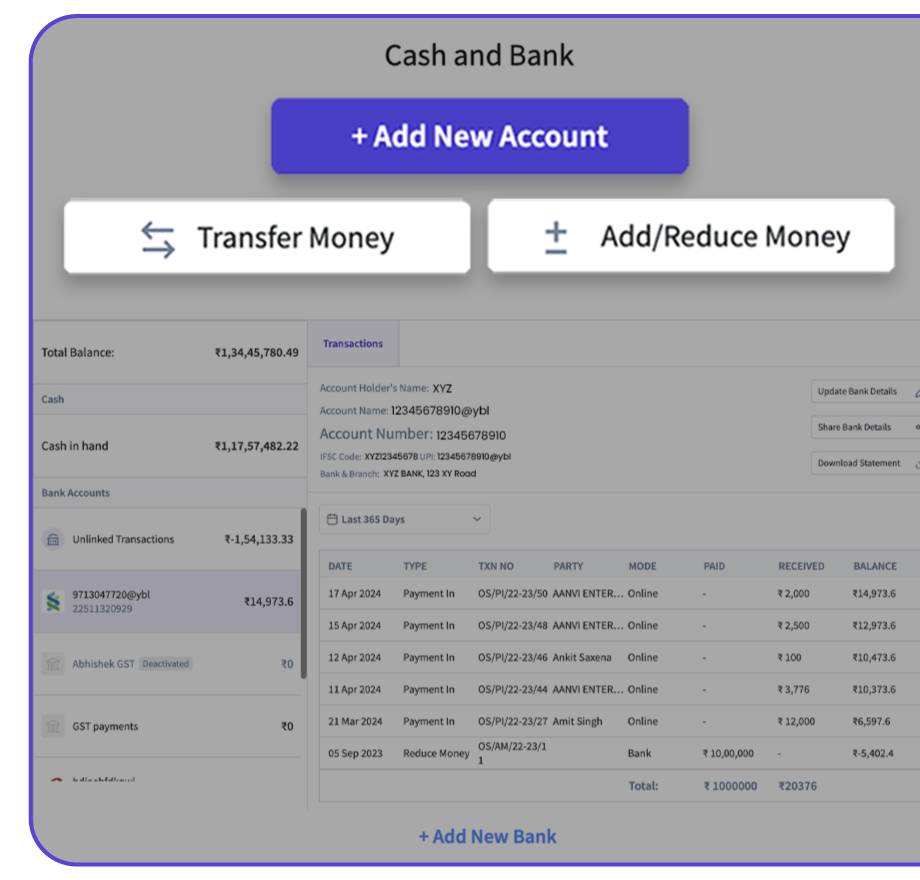

✅ Track receivables and payables

✔ Paid plans starting from ₹34/month

Ready to purchase?

Get up to 35% off on multi-year plans.

Talk to Sales