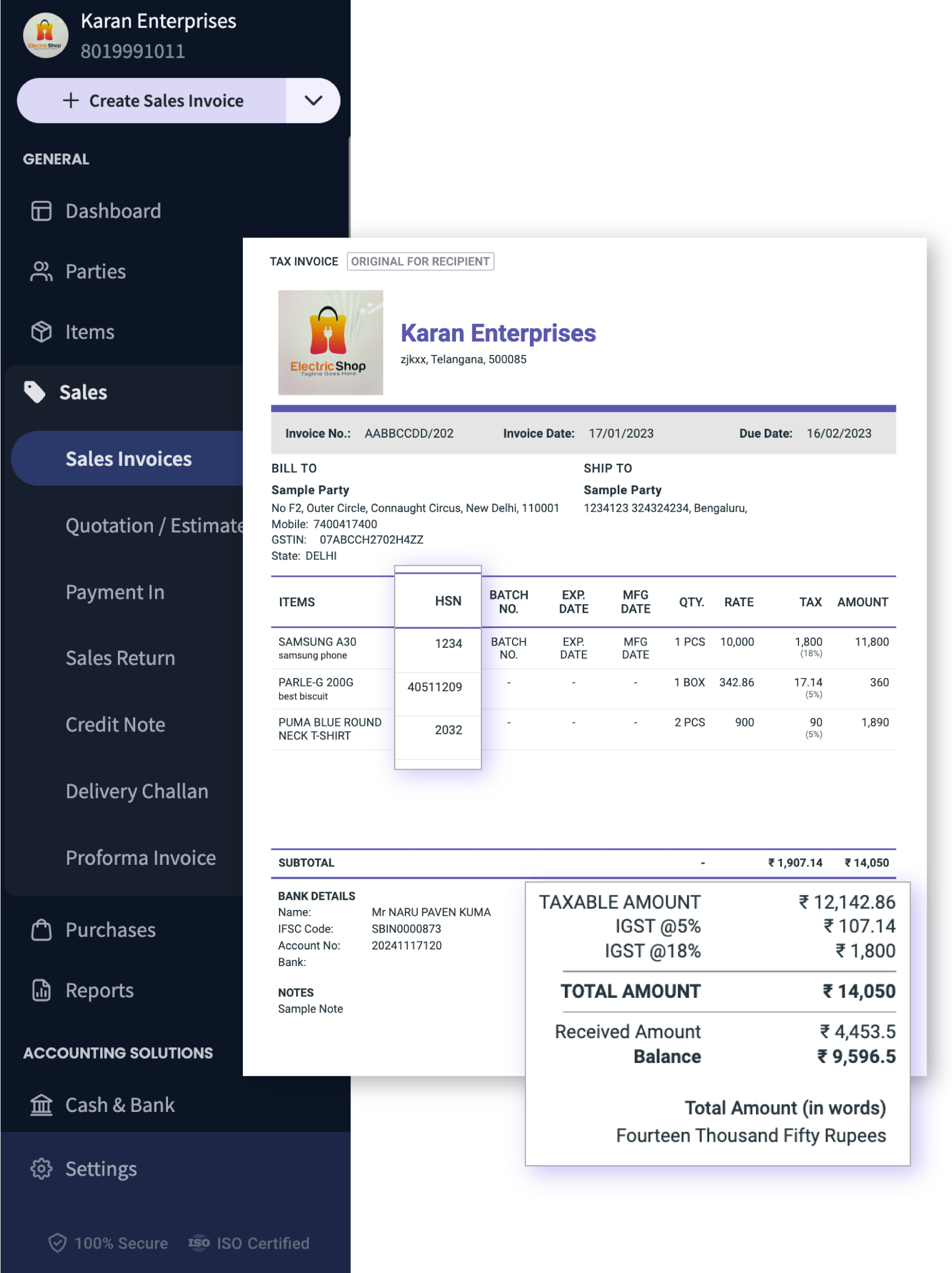

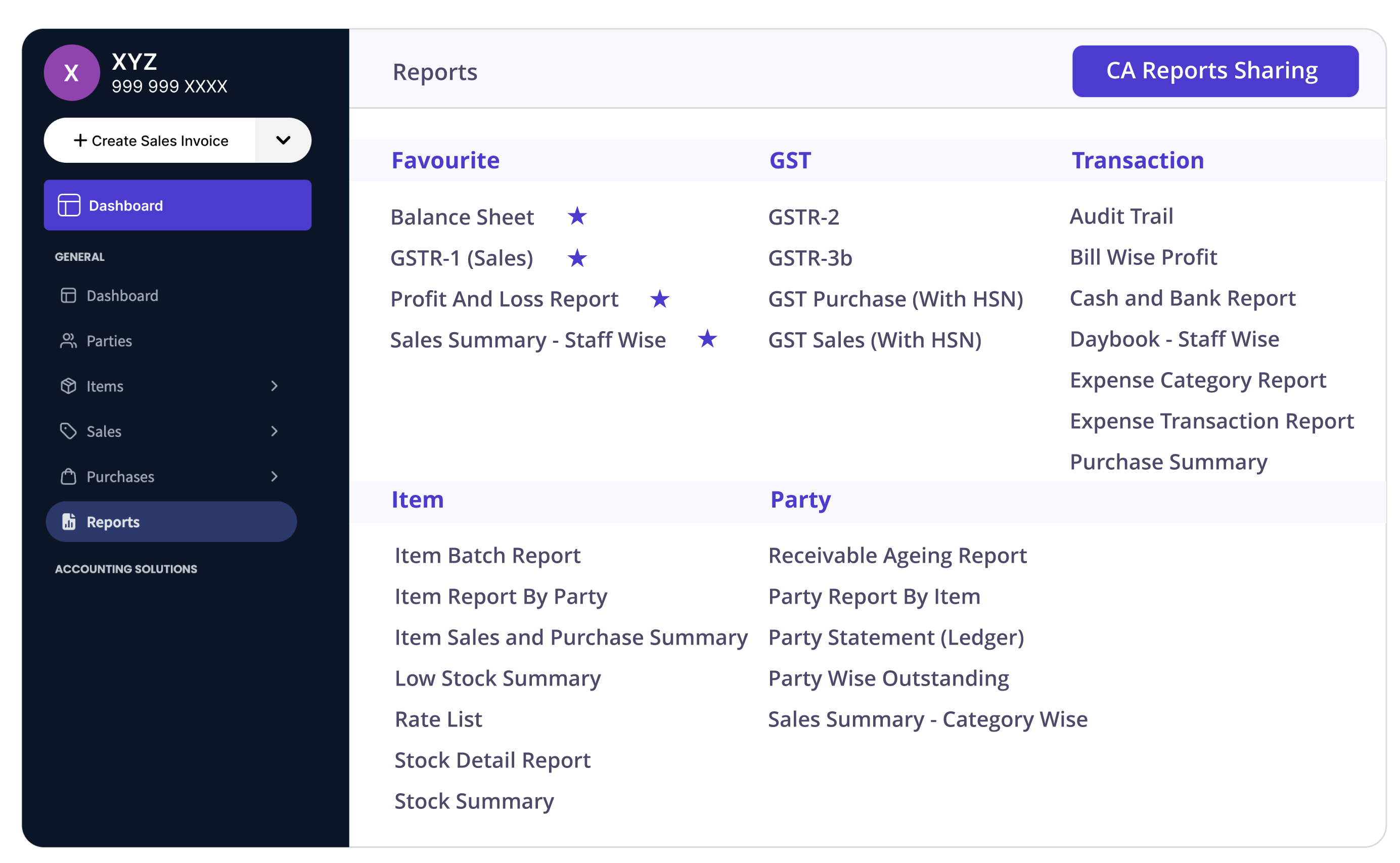

India's best GST billing software

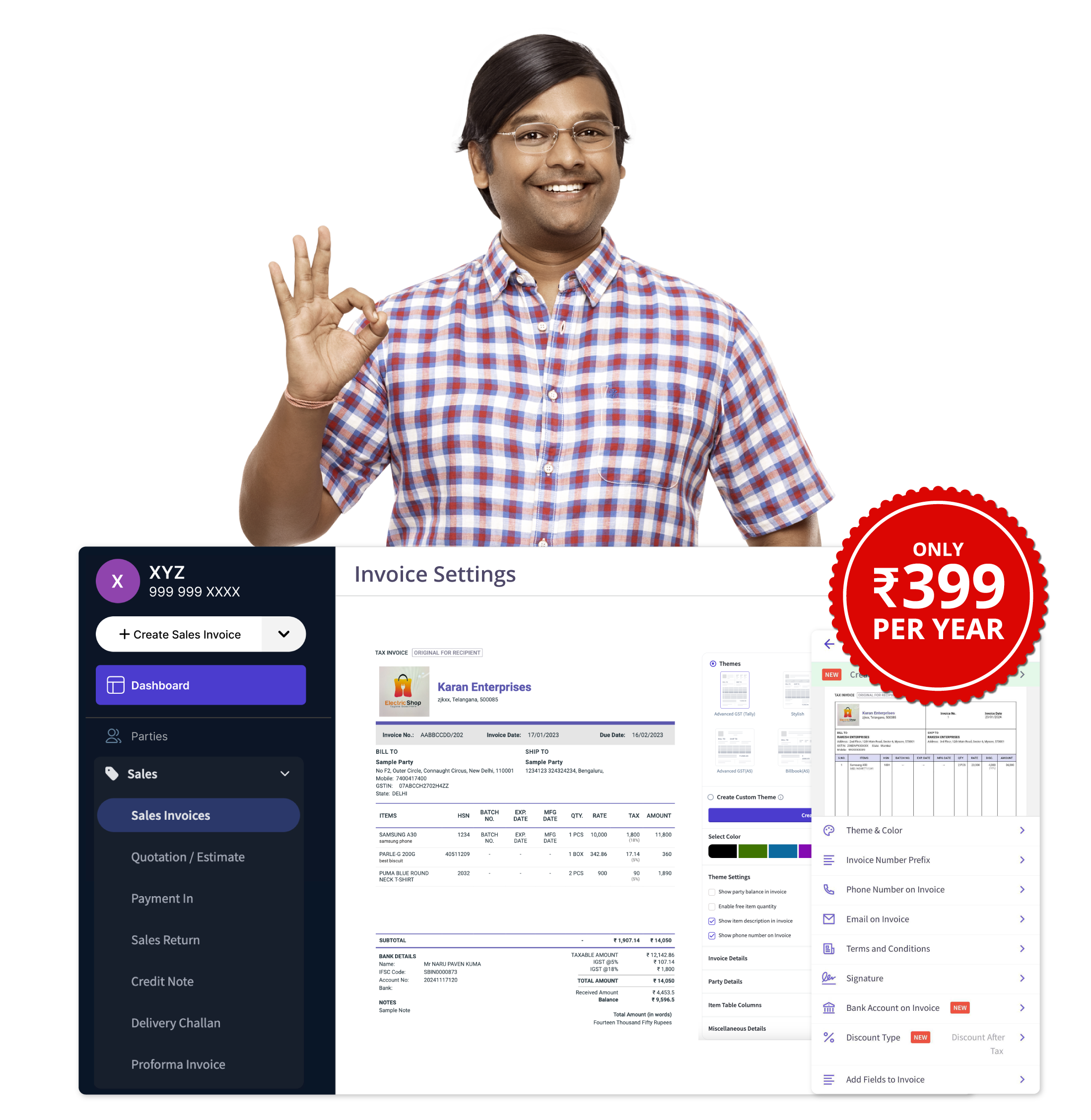

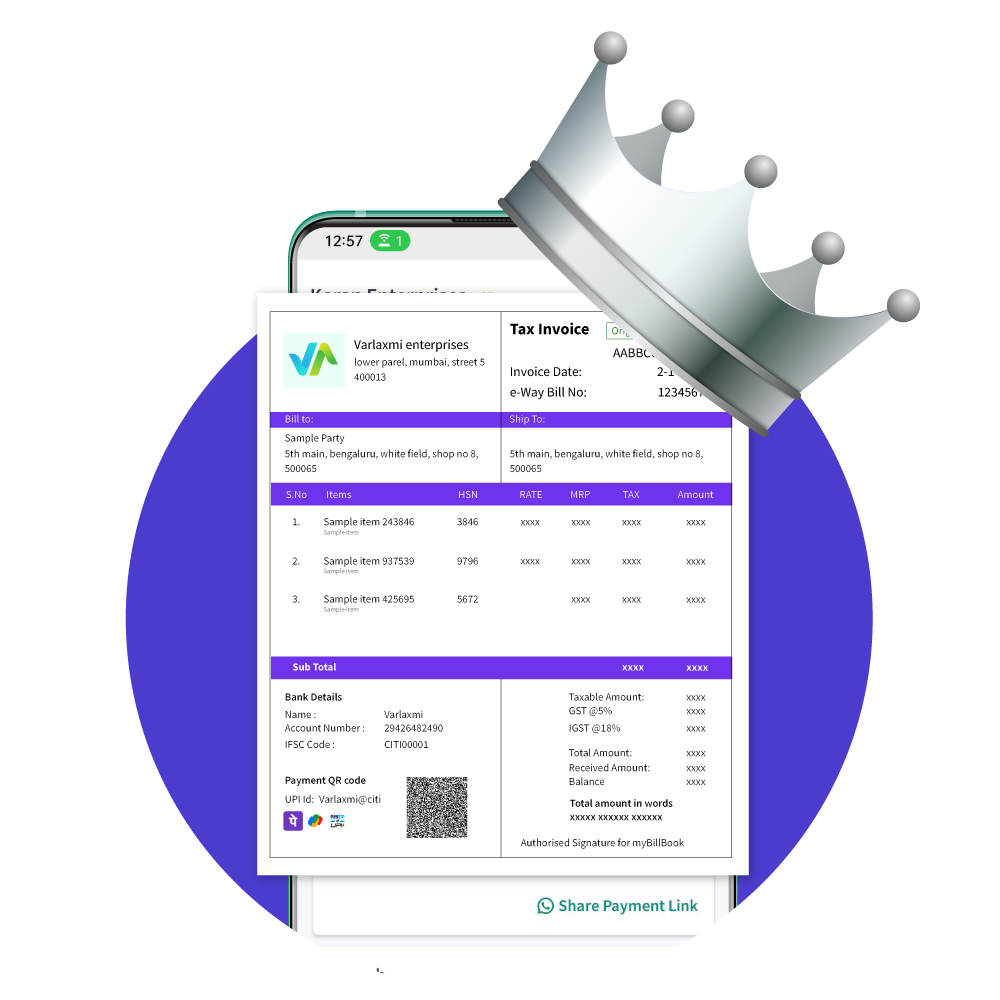

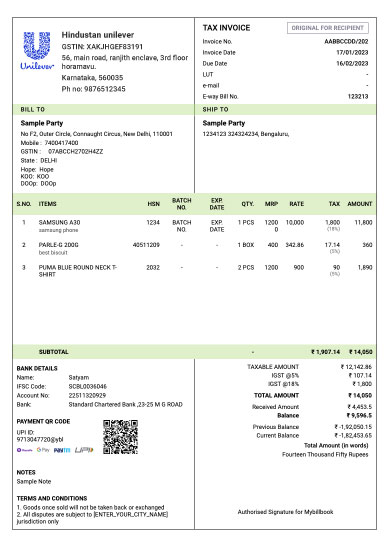

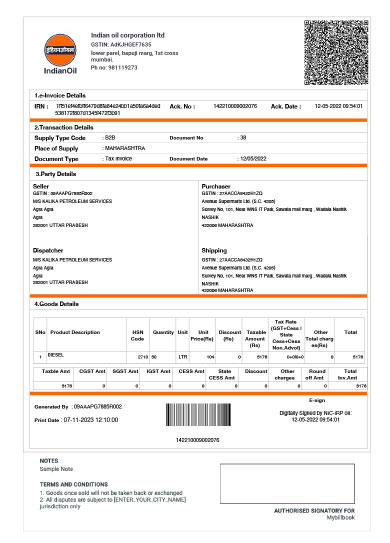

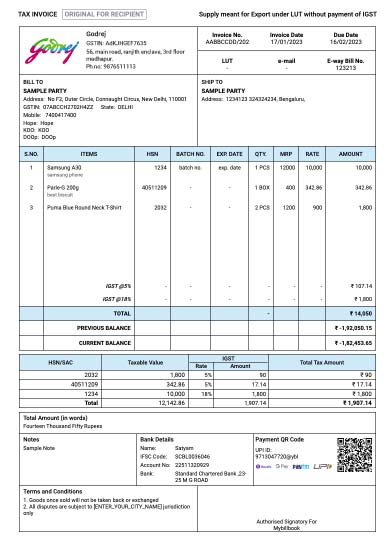

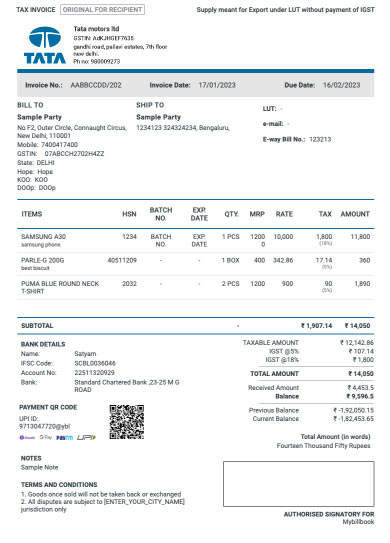

✅ Select beautiful templates

✅ Add your logo and signature

✅ Add any custom fields

✔ Paid plans starting from ₹34/month

Ready to purchase?

Get up to 35% off on multi-year plans.

Talk to Sales